Where are all the Challenger Gym Wear Brands?

Breaking down the lack of gym wear brands in a booming market, and the opportunities it presents.

Whilst Torsa ended up primarily being a running brand, what many don't know is that I originally planned for it to be a gym and training wear brand. In fact, that was the gap in the market I saw having both worked in fashion and attended the gym from the age of eighteen.

Whilst the pivot to running came as a result of analysing the customers buying our product, and the growth in the market at the time (due to COVID), I still, to this day, believe there is a huge opportunity to create a training wear brand that disrupts the market.

As a result of running becoming ‘cool’ in recent years, we have seen a significant flow of new brands entering the market. I like to class these new challenger brands into two distinct categories; those that came before running was perceived as cool, and those that came after.

This, of course, isn’t to say that the new age brands have any less impact (or right to belong) in the market. There ability to succeed, however, is partly due to their intuitive timing, capitalising on a booming industry.

My concern when it comes to the running market right now is its oversaturated. Too many brands doing the same thing, both from a product standpoint, and (critically), community building approach.

I’ll analyse the running industry in more depth in the future. This article, however, is set to discuss why, like running, the gym wear market hasn’t seen the same influx of challenger brands.

The Market

According to Global Market Insights, the global gym apparel market size was estimated at USD 412.6 billion in 2023, and is expected to register a CAGR of 5.4% between 2024 and 2032. Whilst this is a snapshot of the market as a whole, they state that men’s gym apparel segment accounted for a share of 41.39% of the global revenue in 2023.

The majority of market share is captured by the so-called big four (Nike, adidas, Puma and Under Armour). However, there are a handful of challenger brands in the market when it comes to training apparel, namely lululemon, Gymshark and Castore. Whilst none of these brands focus solely training apparel, there offerings have managed to prize away market share from the big four.

I have trained at a number of gyms over the years. When I lived in London, I was fortunate enough to train at Marylebone’s BXR, Islington’s and Soho’s Third Space, Mayfair’s Virgin Active, and a handful of others. Over the years, I witnessed a subtle shift in men’s apparel on the gym floor. From Nike, adidas and Under Armour domination in the early years, I began to see lululemon, Castore, and Gymshark filter through towards the latter part of my time in London.

All the brands above are doing billions of dollars in revenue, so where are all the smaller challenger brands? In running, there seems to be countless success stories of smaller brands making it, but why don’t we see the same pattern in gym wear? Let’s explore.

The Environment

I think it’s firstly important to compare the two environments to understand the disproportionate amount of challenger brands in each market. I want to forward this by saying this is my personal viewpoint, others may see it differently.

For me, the biggest difference between the environments is the community aspect. Whilst running has become as much a social event as anything else, going to the gym feels less so.

Running Snapshot

The rise of run clubs has been meteoric. You have probably seen the stories of run clubs being the new nightclubs, and this is one of the reasons we might be seeing so many challenger brands. Clubs are now seen as social gatherings to meet new people, share freshly baked pastries, and, of course, go for a run.

With this new found social assembly, people also want to look good. In the modern world, run clubs are driven by social media, and being snapped and shared on Instagram is part and parcel.

You only have to look at the likes of Your Friendly Runners carefully curated Instagram to understand the modern age run clubs and their connection to visual identity and aesthetics.

The community aspect of running also means that challenger brands have a platform to succeed. If, as a brand founder, you’re able to tap into the somewhat cult like following of these communities, you have a great foundation for success. As you grow as a brand, you can start hosting your own run clubs, further driving community connection and, in turn, brand loyalty and sales.

Gym Training Snapshot

I’ve been going to the gym for well over ten years so I have seen a lot of different training environments. What I have noticed above all - and how it differs to running - is that the gym, for many, is a place of solitude.

When you step onto a gym floor, I’d say about 90% of people are training alone. Headphones in, not wanting to be distracted, it’s a time for them to be alone and zoned in. Whilst running (and subsequent run clubs) is about community and connection, the gym feels more like a place of individuality and drive. This, in turn, means the community aspect is somewhat lost.

This is not to say that gym wear brands can’t create a community, in fact, I’ll later discuss a gym wear brand that has built a global juggernaut on this very premise. However, this solitude may be in part the reason we haven’t seen the rise of challenger gym wear brands in the same way the running industry has seen.

The gym is definitely still a social playground for many. People don’t spend £250+ on a Third Space membership just to use the pool and sauna. They want to be surrounded by like minded people, socialise, and build connection, but maybe not to the same degree as those that are attending run clubs.

The Rise of the Hybrid Athlete

In recent years, the fitness landscape has changed drastically. Instead of this divide between running and strength training, the emergence of global phenomenon HYROX has seen the two merge into one.

A hybrid athlete can be described as someone who trains and competes in multiple physical disciplines. Unlike traditional athletes who may specialise in one sport, hybrid athletes blend endurance, strength, and skill training.

The hybrid athlete offers up a huge opportunity for new challenger brands. It’s clear that HYROX is here to stay, with Puma announcing they will be the official apparel and footwear sponsor of HYROX races between 2024 and 2027.

I’ll be honest, I think the product is average at best. It feels more like they wanted exposure from partnering with the event rather that actually putting in the time to designing and developing good HYROX suitable product.

They have essentially just taken their core range and added the HYROX logo. Unimaginative to say the least, but for now, i’ll give them the benefit of the doubt as the partnership was only formed last year.

This, however, opens up a huge opportunity in the market. A quick HYROX clothing search on Google drummed up a page dominated by the Puma partership.

However, when I see images from the event itself, I seldom see people wearing the clothing. Would an apparel brand specific to HYROX do well if positioned and marketed correctly? In my opinion, definitely.

Gymshark - A Tale of a True Challenger

When it comes to gym apparel brands, the conversation can’t be had without Gymshark. The story of a small Birmingham based that became a global juggernaut. I spoke about community earlier, and touched on the one gym wear brand that has evidently done just that, and of course, it’s this one.

Gymshark’s success wasn’t down to its product, but instead, its influencer marketing campaign. In its early years, their strategy centred around partnering with YouTube fitness influencers that seemingly had a cult like following. These influencers inspired millions of teenagers and young adults that were just getting into the gym, or starting their fitness journey. Gymshark managed to foster an incredible community of gym-goers, and have since scaled to a multi-billion dollar business.

It’s no secret that Gymshark’s main market is between 16 - 25, with the majority I suspect between 16 - 21. In fact, a clear example of this is when I am back in the UK, I attend a university gym near my home. Of the 70% of students wearing branded sportswear, I’d say between 70% - 80% tends to be Gymshark. This is pretty incredible that one brand can dominate a segment this much. Compare this to when I attend Third Space in London, I might see about 5% Gymshark. This mainly comes down to their brand image, product designs, and influencers, which consist of ripped young bodybuilders; something teenagers find inspiration in, but adults working a 9-5 don’t.

Gymshark has such a stronghold on the younger market, and say what you want about the aesthetics, but it’s one of the only brands that has successfully positioned itself as a gym and training wear brand. It’s of course in the name.

Gymshark even reaffirmed itself as a gym-first brand, with the launch of last years “We Do Gym” campaign.

Gymshark being a global brand has meant it has of course has diversified its offering into many other categories. However, its roots as a gym-first brand are clear to see, and one of the biggest challengers to the so-called Big Four.

With such a dominance in the mass market space, the opportunity for a gym challenger brand doesn’t lie here, it lies on the other end of the scale.

The Opportunities

The gym wear and training industry is rife with opportunity. The market in which I see the most potential is the premium and luxury market. Having worked at lululemon in the past, I saw the substantial growth of menswear, which now equates for approximately 20%-25% of global revenue.

Naturally, Lululemon is popular with affluent individuals. It’s one of the pricier brands on the market, but in truth, it’s still very accessible (especially if you have the money to spend £250+ on a gym membership.)

Whilst lululemon is one example, there aren’t many others, especially menswear, that operate in that space. One brand who did, but have since pivoted to mass market, were Castore. At the start of their journey Castore catered for that high-earning, high-achieving customer. As it grew and raised substantial capital, it began diversifying its offering and reducing the price point to capture a wider market.

Therefore, the fact remains, the premium and luxury training wear space is severely underrepresented. One brand that seems to be doing good stuff in the space is Vancouver brand Reigning Champ. So much so that back in 2021 Aritzia bought a 75% stake in the company at a $63 million dollar valuation. Whilst Reigning Champ are known mainly for their high-quality sweatshirts and sweatpants, there performance offering is really nicely done.

This is a brand, however, that I rarely see in the UK. Whilst at one point it was stocked on Mr Porter and Matches, it’s now not on the former, and of course, after its closure, not on the latter.

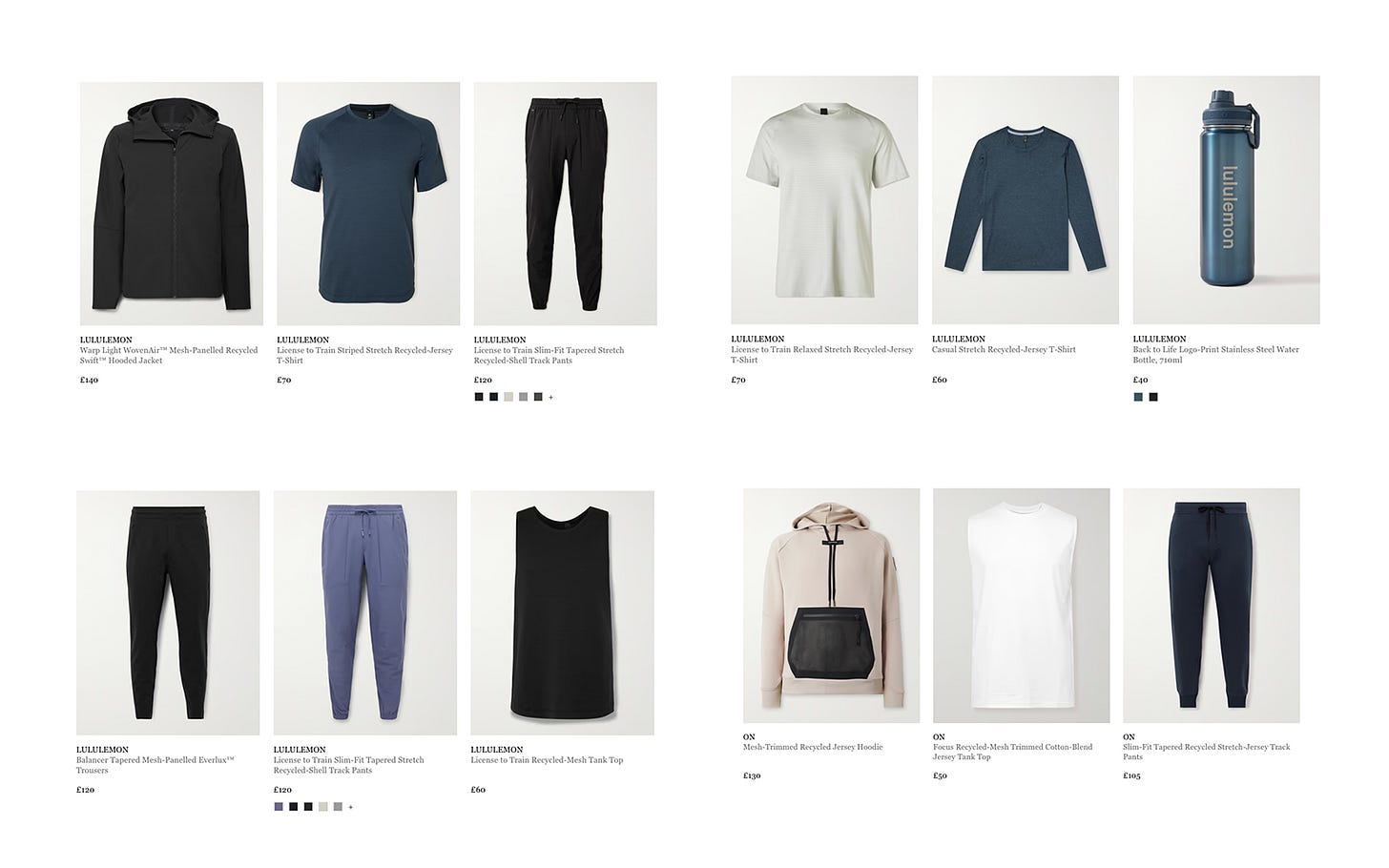

In fact, when I look at Mr Porter and click on the training category, I find it truly incredible that it represents just two brands; lululemon and ON Running. The latter, not even a training brand at all.

In the running category, however, you have Satisfy, District Vision, ON Running, lululemon, Nike Running, Portal and Hoka. So, what’s the deal? Is there no demand for training brands or are Mr Porter just reducing risk and investing in brands that they know work, like lululemon?

Innovation in Training Footwear - R.A.D®

Whilst apparel seems to be faltering in the training space, in footwear, one challenger brand has announced itself, R.A.D®. Founded by Ben Massey, R.A.D® is built on the belief that training is the foundation of success in any athletic pursuit. I tend to agree. On their website, they state;

We have cultivated a community that chases athletic performance, embraces freedom of expression, and thrives on the spirit of the underdog.

The original R.A.D® One training shoe was a direct competitor to the popular Nike Metcon. Ben, a former CrossFit Games athlete with a background in skateboarding and street fashion, wanted the R.A.D® One to disrupt the status quo. The idea was taking a performance-first approach without compromising on aesthetics.

When they launched the R.A.D® One V2 earlier this year, Tom Berend, R.A.D®’s head of footwear design and a former employee of Nike and Adidas, said;

The V2 pushes boundaries, balancing performance, comfort, and style. It’s designed to meet the demands of serious athletes while looking just as good off the gym floor.

Under the guidance of Ben and his team, R.A.D® have built a loyal following of athletes across the globe. Helped by their unique marketing and branding, in which is inspired by a mid 90's fascination with the future - a time where the potential of what the internet could do to society, was omni-present yet unimaginable, R.A.D® have created something in the footwear space which the industry is similarly crying out for in the apparel space.

What R.A.D® also goes to show is that you can build a brand within the training space that not only competes against the likes of Nike, but thrives against it.

R.A.D® were unique in its approach to product and marketing, and because of it, they have been successful in disrupting a notoriously difficult market.

Brands on the Radar

WIT Training

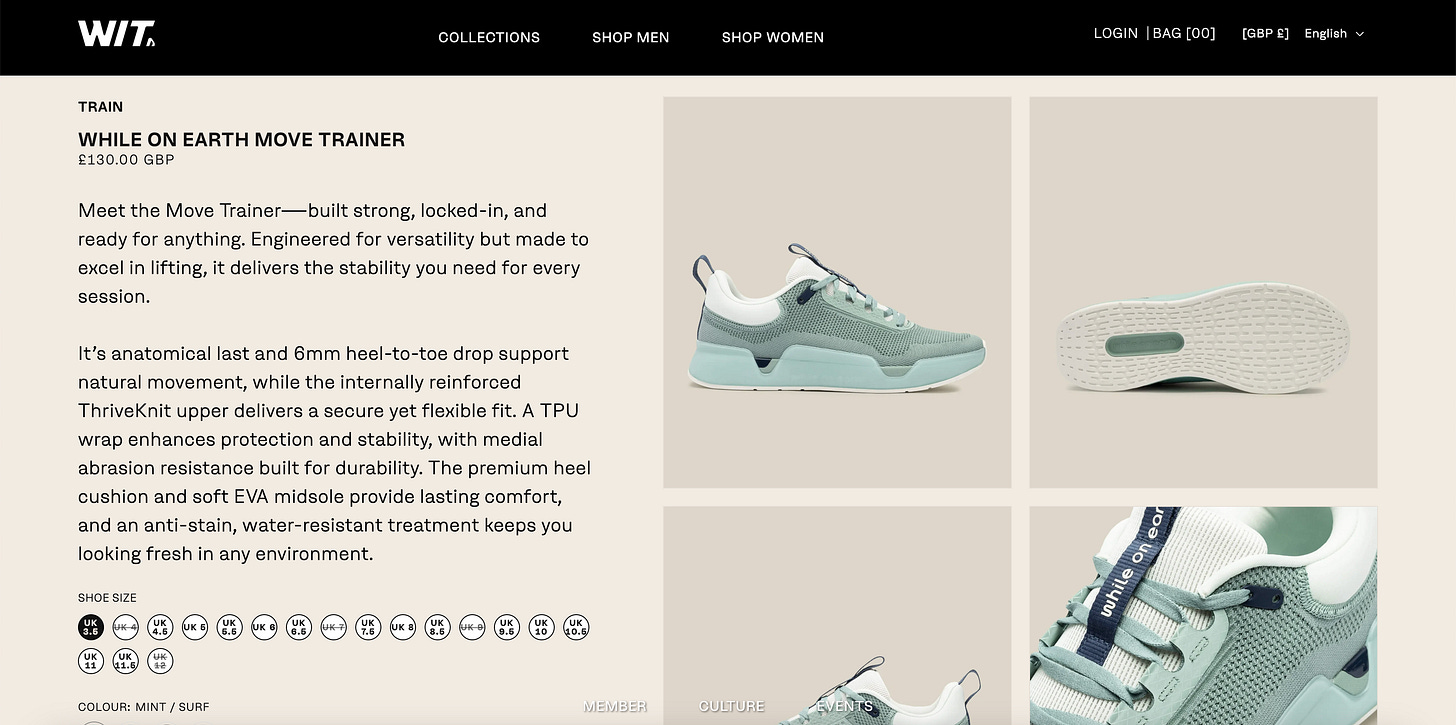

Spearheaded by fitness industry experts Dan Williams and Sam Kitching, WIT, which was formerly a premium London CrossFit facility, combined with online retailer, relaunched earlier this year.

Whilst the previous business model combined collaborations and exclusive drops with big brands, the new strategy aims to shift the focus onto own brand product. This makes sense as WIT previously had of the strongest communities on the London fitness scene.

They will still, however, collaborate with other brands. For now, the renewed focus seems to have shifted to challenger brands, such as R.A.D® and While On Earth in the footwear space.

Time will only tell to see how the apparel and footwear offering develops, but whilst previously much of the stock was from the big sportswear giants, WIT has a clear renewed focus on own brand product with the launch of their Core Collection 1.0.

With technical product said to be on the way later this year, I will be keeping a keen eye on the development in hopes we see a rise in a fresh challenger brand, which has significant knowledge and industry expertise behind it.

Ten Thousand

Sporting the motto, better than yesterday, mens athletic brand Ten Thousand represent the dedication to continuous improvement. Ten Thousand are certainly a brand representing intense training through and through. They also utilise a rigorous athlete testing programme to ensure the product they bring to market is top notch.

The product itself is stripped back, and in their words “No BS. No gimmicks. No endless scrolling through indistinguishable products. We pared back our line to create a system of gear that’s perfectly designed for all the ways you train.”

Their best selling Interval Short which boasts a staggering 6000+ reviews on their website was the foundation to their success. They launched, to my memory, with just a set of two products; a t-shirt and shorts. Since then, they have gradually scaled the business and back in 2023 landed a $21 million series funding round.

There is no doubt that Ten Thousand capitalised on the lack of quality mens training apparel at the time. Through a combination of a durable well made product and building a network of aspirational athletes, they have continued to make a dent in the men’s activewear market.

When it launched back in 2017, its durability and understated aesthetics made it really popular with CrossFitters and military operators. Now, with fresh funding, they have grown their product offering to include apparel across train, recover, live, and tactical categories.

Jacques NYC

Another brand out of the US which has dipped their toe into the activewear space is Jacques NYC. Founded by Gregg Cohenca in 2018, Jacques takes a different approach to activewear with minimal design inspired by architecture and natural elements, like concrete, stone, clay and water, and crafted with premium fabrics.

Its initial launch saw a series of activewear staples in a more elevated, contemporary style than its competitors, which included tennis stapes (in which Greg was a former player).

Their more traditional training products was called the Movement range. This first consisted of a t-shirt and shorts has now evolved into a multi-product range of products, sporting with long sleeves, running tights, polos and jackets.

It is, seemingly, tennis and lifestyle that seems to be the primary focus for the brand. They recently launched their Tennis 006 range and Fall/Winter range of lifestyle products.

Aesthetically, Jacques is lovely. It’s subsequent focus on tennis and lifestyle, however, means it falls out of the typical activewear challenger brand category.

Final Thread

The gym wear market makes up a significant portion of the sportswear market as a whole. The clear lack of true challenger brands presents a huge opportunity in an industry which continues to grow year on year.

The opportunity I see falls within the premium and contemporary space, in which for menswear specifically, lululemon has a stronghold on the UK market, with far greater exposure and distribution outlets than its nearest competitors. Brands like NOBULL, Ten Thousand, Vuori and Rhone all have market share, but primarily in the US.

The success of launching a premium gym wear brand is first understanding what is missing. What draws me to the premium space is this idea of serving a customer that isn’t just about power, grit and determination - for which, brands like NOBULL, Rogue and Ten Thousand tailor their message. The idea of creating a product that is incredibly well crafted, understated, and aspirational to the high-achievers - that is where I see the opportunity.

Incredible piece right here. I posted a note about this very issue last week. The empty space exists because we’ve yet to have a zeitgeist moment that brands like Tracksmith, District Vision, or Bandit have had with running.

In the training world’s defense, the running culture is larger and more communal and tribe-oriented. Still.

I’m surprised at the massive hole that exists for strength and conditioning culture.

Very insightful Sev. As a sports photographer & filmmaker I can related to what you wrote.